Market Competition under Unusual Times: Who soars up against the trend or falls downward with the trend?

The art market in 2020 was once nearly closed due to the COVID-19 and many other factors. This year’s Hong Kong Spring Sales are more than 3 months later than in previous years, and the market competition in unusual times has attracted great attention. Auction houses have no choice but to change their sales to the same time. Confronting marketing fluctuations, artists offer different performance – some are far ahead and some are temporarily behind. How’s the anti-volatility ability of the Hong Kong art market and popular artists? After all the noise and bustle, let’s see the objective and rational results brought by the market and data.

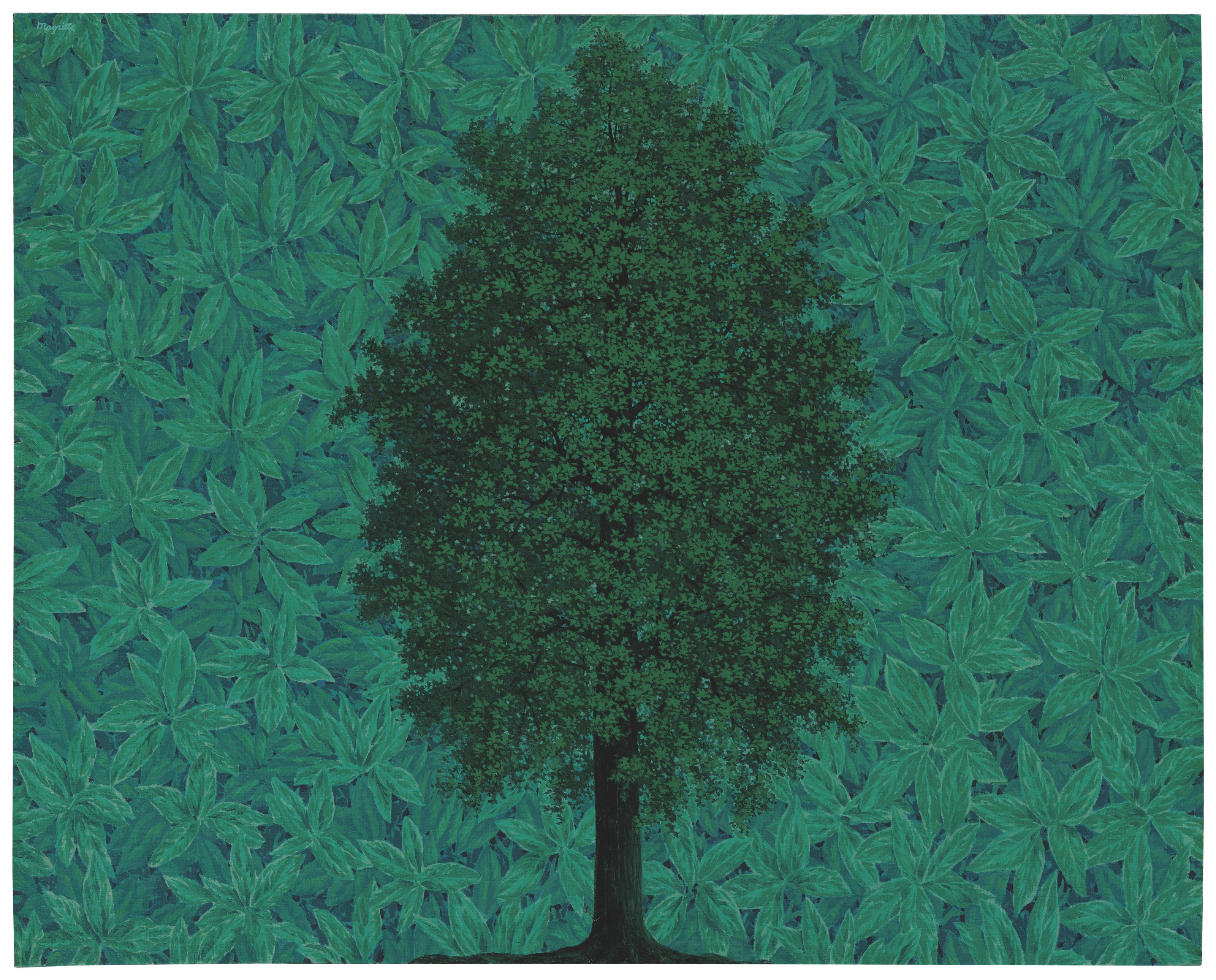

Soaring Hong Kong Price Index: It’s not the first time showing its anti-volatility ability.

In terms of the price index, Hong Kong price index shows a large increase, far ahead of the ArtPro 100. Speaking of the transaction volume, Hong Kong has earned US $466m in only half a year. The uniqueness and specialty of this market contribute to no significant shock but a relatively surprising score.

The regional resilience is not surprising. Looking back at the economic crisis in 2008, Hong Kong’s art market did not suffer a violent shock as well. The price index was almost stable and excessive, and the total turnover reached a record high of US $348m.

(Global ArtPro 100: Selected from the top 100 artists’ turnovers in global area, calculate the index ; ArtPro Hong Kong: Selected from the top 100 artists’ turnovers in Hong Kong area calculate the index.)

Generally, the overall market performance of Hong Kong remains impressive. From the perspective of artists, they’ve performed differently in the face of market fluctuations. Now, please follow ArtPro to explore the artists’ different performances in the spring sales.

Art Market under Cloud of Pandemic: Unstoppable Classic Artists

Battle-hardened artists continue to bring good news, giving the Asian art market a shot in the arm. This time, Hong Kong Spring Sales have 7 pieces of lot sold over HK $100m, by San Yu, Zao Wou-Ki, Chu The-Chun, and David Hockney respectively. The occurrence of high-priced lots once again confirms the unstoppable strength of these artists against the trend. Does the performance of art market in the first half of the year indicate the opening of the second half? The future is more anticipating.

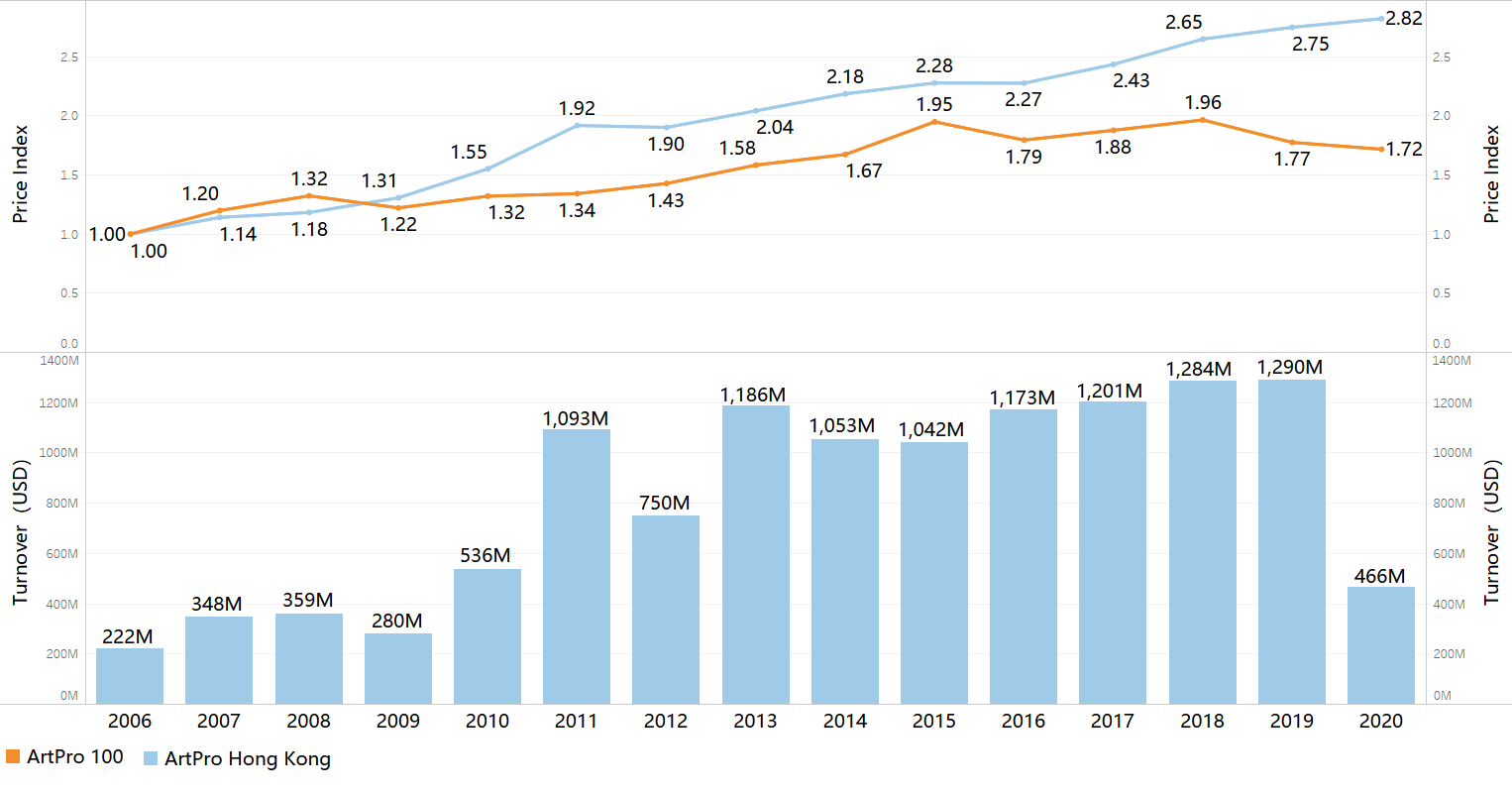

San Yu: Over US $100m Tallied in 2019, Unstoppable Trend in 2020

After “San Yu Heat” in 2019, San Yu’s power in 2020 is still considerable. With the total turnover of the spring sales of US $64.6m, it has over-passed half of the total in 2019. It can be said that 2019 is the first year of San Yu’s outbreak, shocking the auction scenes by doubling the total turnover of 2018 – a record high, helping him become a new star into Hundred-Million Club.

Despite that the art market in 2020 is facing many unexpected challenges, San Yu’s heat in the market is still unstoppable. His “nude women” once again achieved a high price, while his “flowers” sold over $100m becomes the spotlight in the sales. Sold for HK $191m, San Yu’s Chrysanthèmes Blanches Dans Un Pot Bleu Et Blanc (White Chrysanthemum In A Blue And White Jardiniere) has renewed his still life painting record. Quatre Nus ranks TOP2 with HK $258m. In terms of the total turnover, San Yu has brought US $64.67m merely from the spring sales, more than half of that in 2019.

Quatre Nus, 15 years 15 times

In terms of annualized return, Quatre Nus is auction at Sotheby’s with estimating price upon for request, and finally brought in HK $258m in total – 15 times in 15 years, with an annualized rate of return of 20%. Chrysanthèmes Blanches Dans Un Pot Bleu Et Blanc was sold for HK $ 7.88m in 2005, and after 15 years, it reappears at the sales of Christie’s and is sold for HK $191m, with an over-low-estimate rate of 181.38%, 24 times in 15 years, with an annualized return rate of 24%. Thus it can be seen that the sky-high price “nude women” by San Yu are of considerable value, while the potential value of his “flowers” shall also not be underestimated.

Chrysanthèmes Blanches Dans Un Pot Bleu Et Blanc, 15 years 24 times

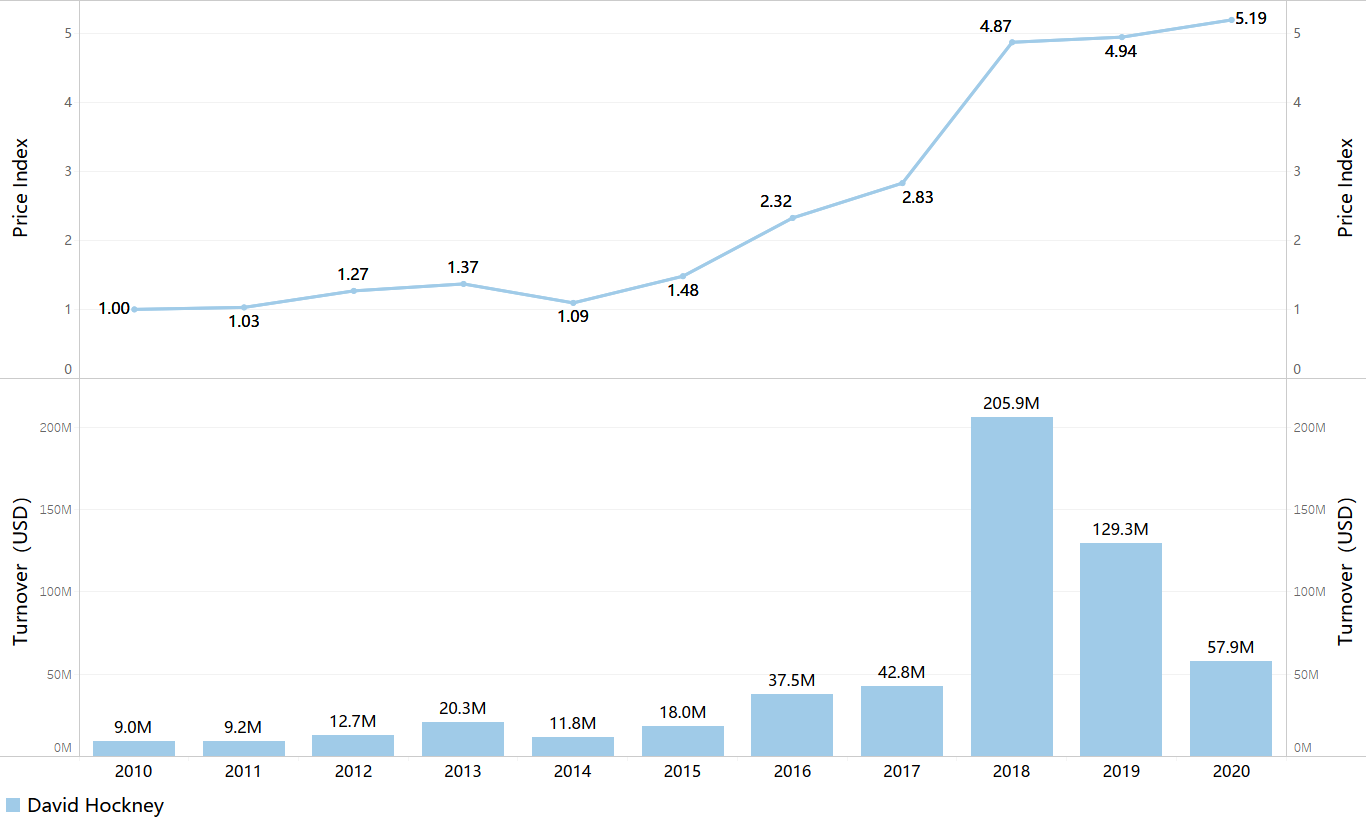

David Hockney: Most Expensive Living Artist in 2018, with Splendid Achievement again in Asia in 2020

David Hockney has long made his name in the art world, and became a worldwide hit in 2018 when his Portrait of an Artist (Pool with Two Figures) was sold for sky-high price $90.31m in New York, making him the most expensive living artist ever. His boom does not stop, especially this year when art market is under the shadow of the “pandemic gloom”. David Hockney’s price index has not fallen but stayed high and is on the rise, really expecting.

In 2020, David Hockney set the record of most expensive bid in Asia. His masterpiece 30 Sunflowers, sold for HK $114m with commission, becomes the second most expensive western art work auctioned in Asia, right after the THE KAWS ALBUM sold for HK $115m last year.

30 Sunflowers, 9 years 5 times

In terms of annualized rate of return, 30 Sunflowers was once auctioned in Phillips and sold for US $2.55m in 2011, the TOP1 deal of the artist that year. 9 years later, the lot reappears in sales and sold over $100m, 9 years 5 times, with an annualized rate of return of 21%, indicating the extraordinary performance of western art in Asian market.

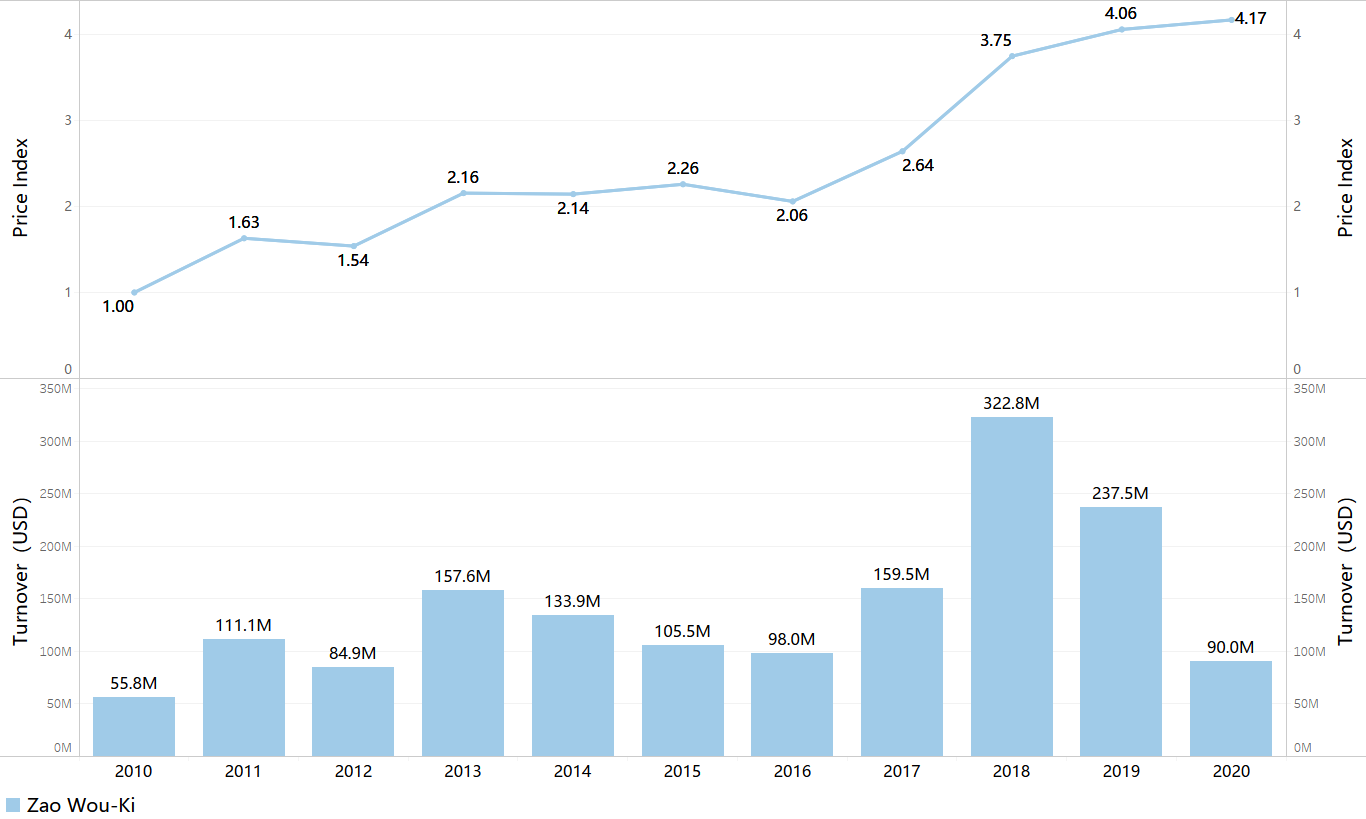

Zao Wou-Ki: the current trend under the pandemic is still sharp, three pieces over 100m lots as achievements

In the first half of 2020, 93 out of Zao Wou-Ki’s 111 pieces of lots are sold, with a sold-by-lot rate of 83%, and his price index remains stable at a high level. Zao Wou-Ki does not take the lead momentarily, but galloping winner in recent years. During the pandemic, Zao Wou-Ki delivers a mighty performance as usual, a king far ahead of others at auction scenes.

Zao Wou-Ki’s 33 paintings are auctioned and 31 of them are sold in the Hong Kong Spring sales. Among them, 3 pieces are sold over HK $100m, with 20.03.60 and 18.11.66 bringing HK $115m respectively, ranking TO9 and TOP10; 19.11.59 is sold for HK $110m. The overall trend of Zao Wou-Ki’s market condition remains stable, while a blemish in an otherwise perfect thing is that another piece 21.10.63 failed the auction at last. It also reflects that collectors may have multiple choices facing a series of Zao Wou-Ki’s high-qualified lots, and this may leave some impact on the deal to some extent.

19.11.59,11 years 3 times

On an annualized basis, 19.11.59 was sold at Christie's for US $3,933,000 in November 2009. It is up for auction again 11 years later and sold for $14,121,080, 11 years 3 times with an annualized rate of return of 13%.

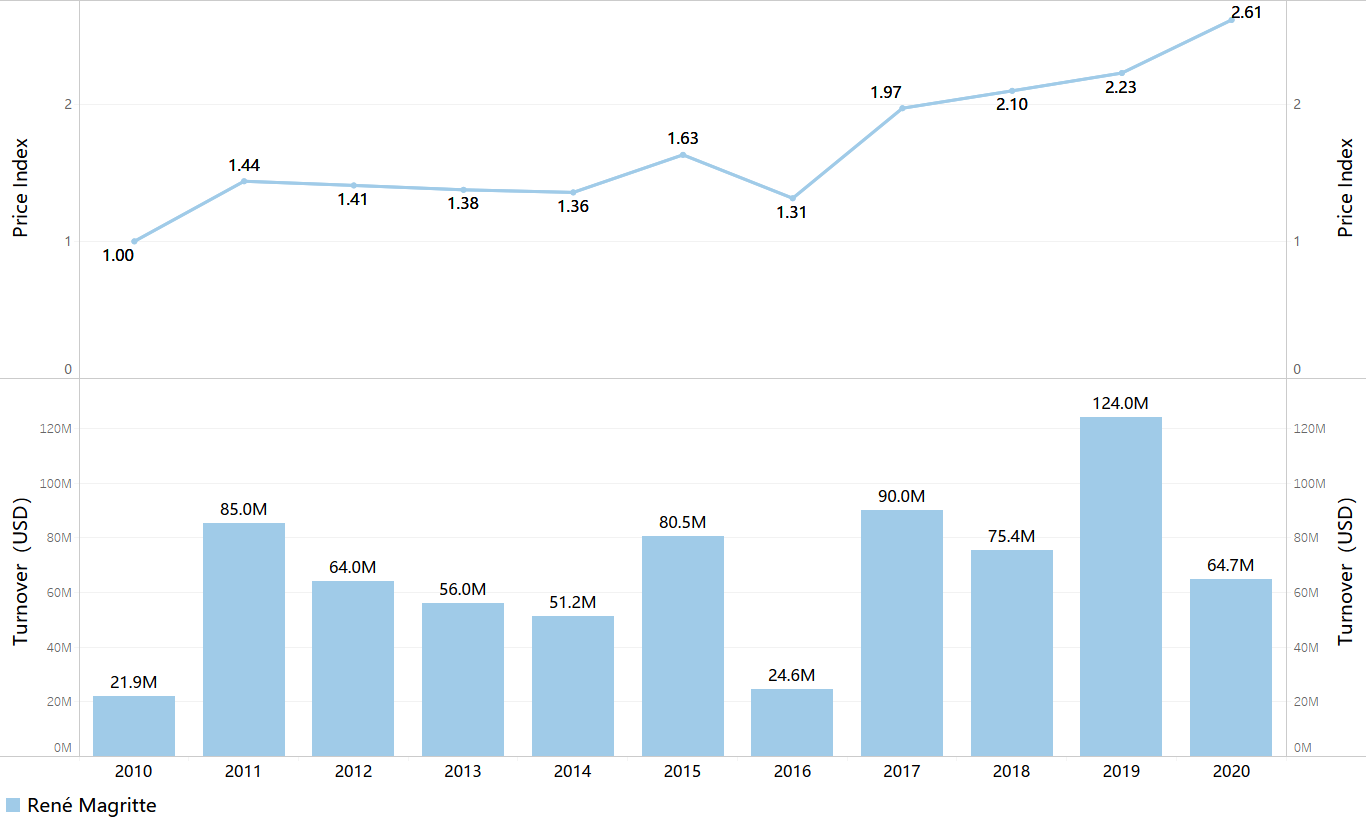

René Magritte: Eye-Catching Hundred Million Total Turnover in 2019, and another Lot over Hundred Million in 2020

In 2019, René Magritte reached his personal peak by bringing his transaction volume to more than a hundred million. In 2020, he achieves half of that of last year within half a year with strong market performance. His price index is soaring in recent years with marvelous scores. Let expect his heat will continue in the second half of 2020.

In terms of lots, it also confirms the deep focus from the market towards René Magritte. After A La Rencontre Du Plaisir sold over a hundred million in 5 February, ranking TOP2, René Magritte has his another painting sold over a hundred million in the July spring sales – L'arc De Triomphe is sold for US $21.97m, ranking TOP4.

L'arc De Triomphe,28 years 19 times

In terms of annualized rate of return, L'arc De Triomphe was sold for US $1.15m in 1992, and after 28 years, its value has increased from million dollars to ten million dollars. 28 years 19 times, the annualized rate of return is 12%.

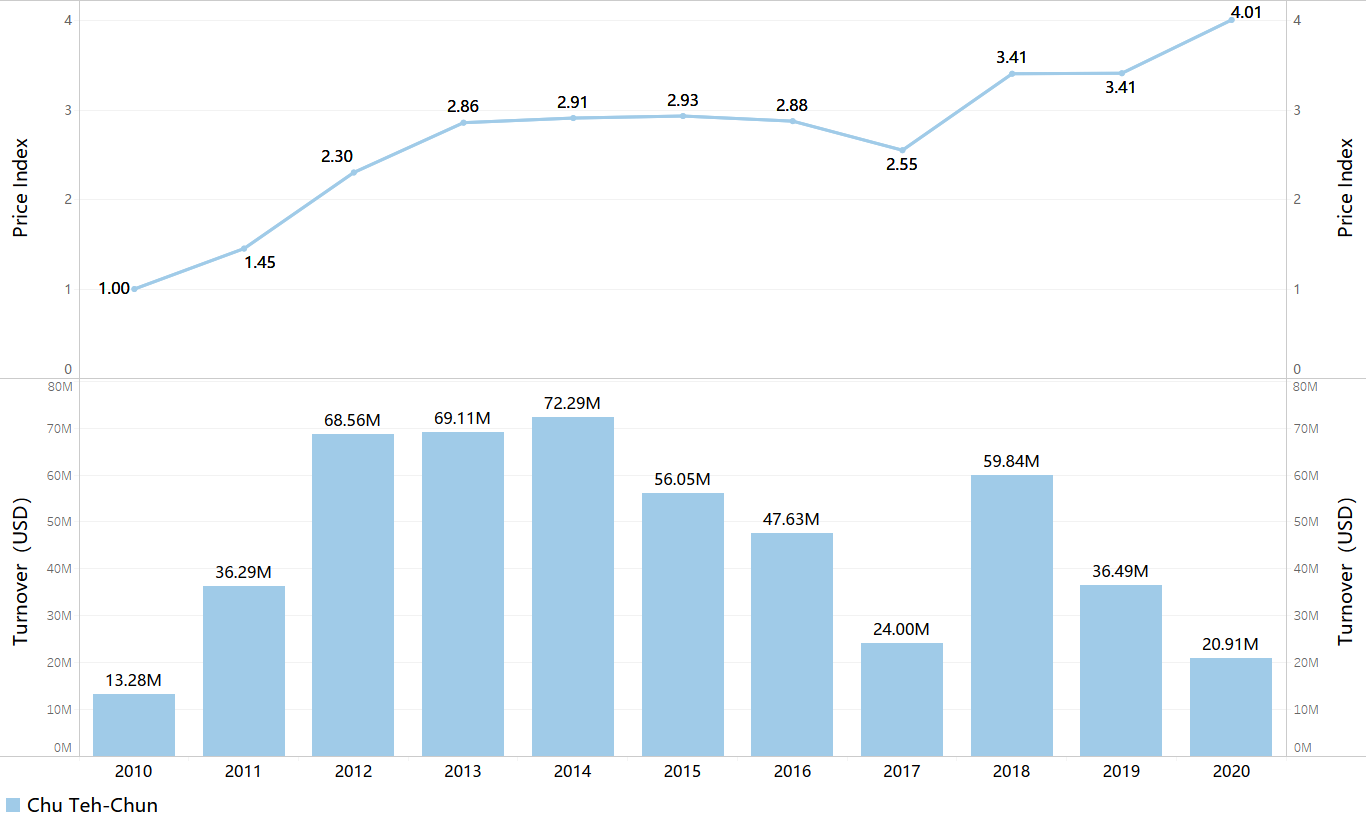

Chu The-Chun: Price Index Shows Growth Peaks, 2020 into a Hundred-Million Club

Among the three musketeers studying in France, Chu The-Chun is not as popular as Zao Wou-Ki and Wu Guanzhong, but his works shall not be underestimated. His price index was once at the peak in 2014, and has restarted the rising trend since 2018. This year is also the centennial of the artist's birthday, which may offer a chance for price rising, creating an impressive market trend.

The only pentaptych oil painting in his life Les Éléments Confédérés, sold for HK $114m, has renewed his personal auction record before. It is also the artist’s first lot sold over a hundred million HKD.

Some/Other artists: Slight “Depression” in the first half of the year

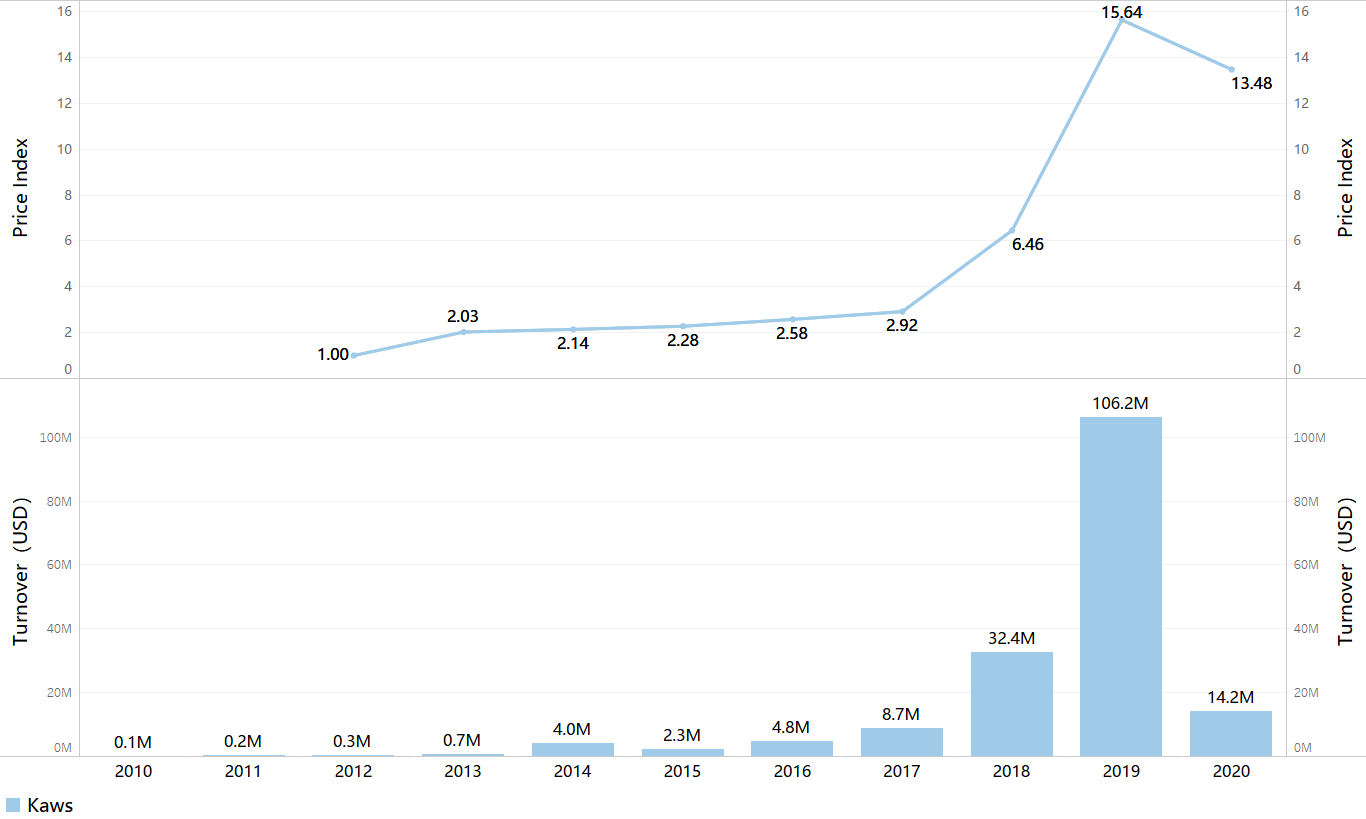

Kaws: Slight Market Downwards in 2020

Kaws was once all the rage in 2019, earning full attention not only from the social circle but also the auction market, with 9 works of his TOP10 sold in 2019, among which THE KAWS ALBUM was sold for 115m HKD, surprising the art world. Half of his accomplishments are contributed by the Hong Kong market. However, in the first half of 2020, his heat seems to suffer a slight recession. With the lots amount of 233 but a pass volume of 69, his sold-by-lot rate only reaches 70%. The price index drops a little, and the transaction volume US $14.2m meets only one eighth of that of last year. This might be due to many factors, such as the lots on sale are not his best works. It is worth looking forward to his development in the second half of the year.

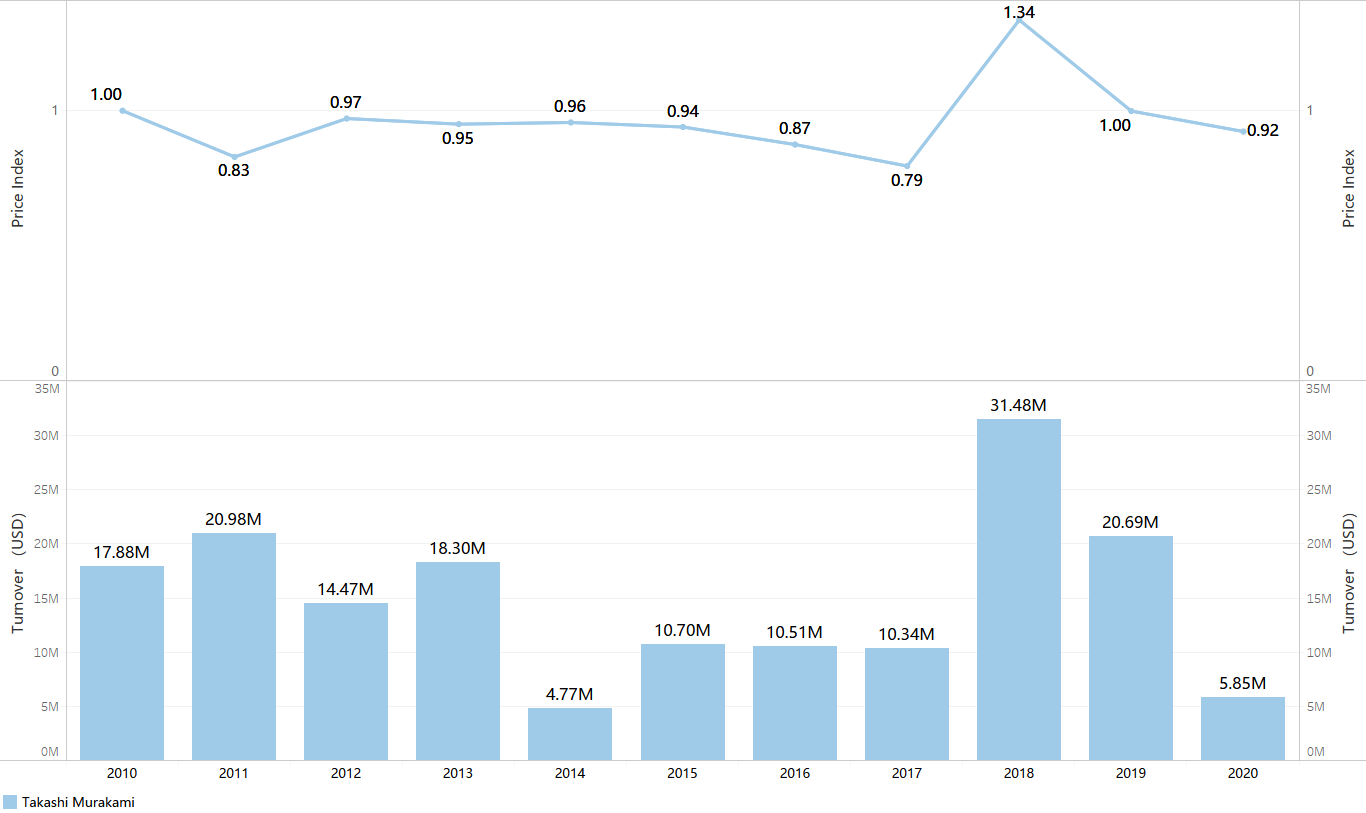

Takashi Murakami: Price Index falling for 2 Consecutive years, a Tough 2020

Takashi Murakami, a symbol of contemporary fashion, but the glory is hard to keep lifelong. His price index has fallen for 2 consecutive years since 2018. This year, in particular, 194 works are sold in the first half of the year, but the total turnover is only US $5.84m. Due to the COVID-19 pandemic and other factors, his gallery and art team are severely hit and confessed that they’re facing bankruptcy. It will be really tough to get out from the adversity.

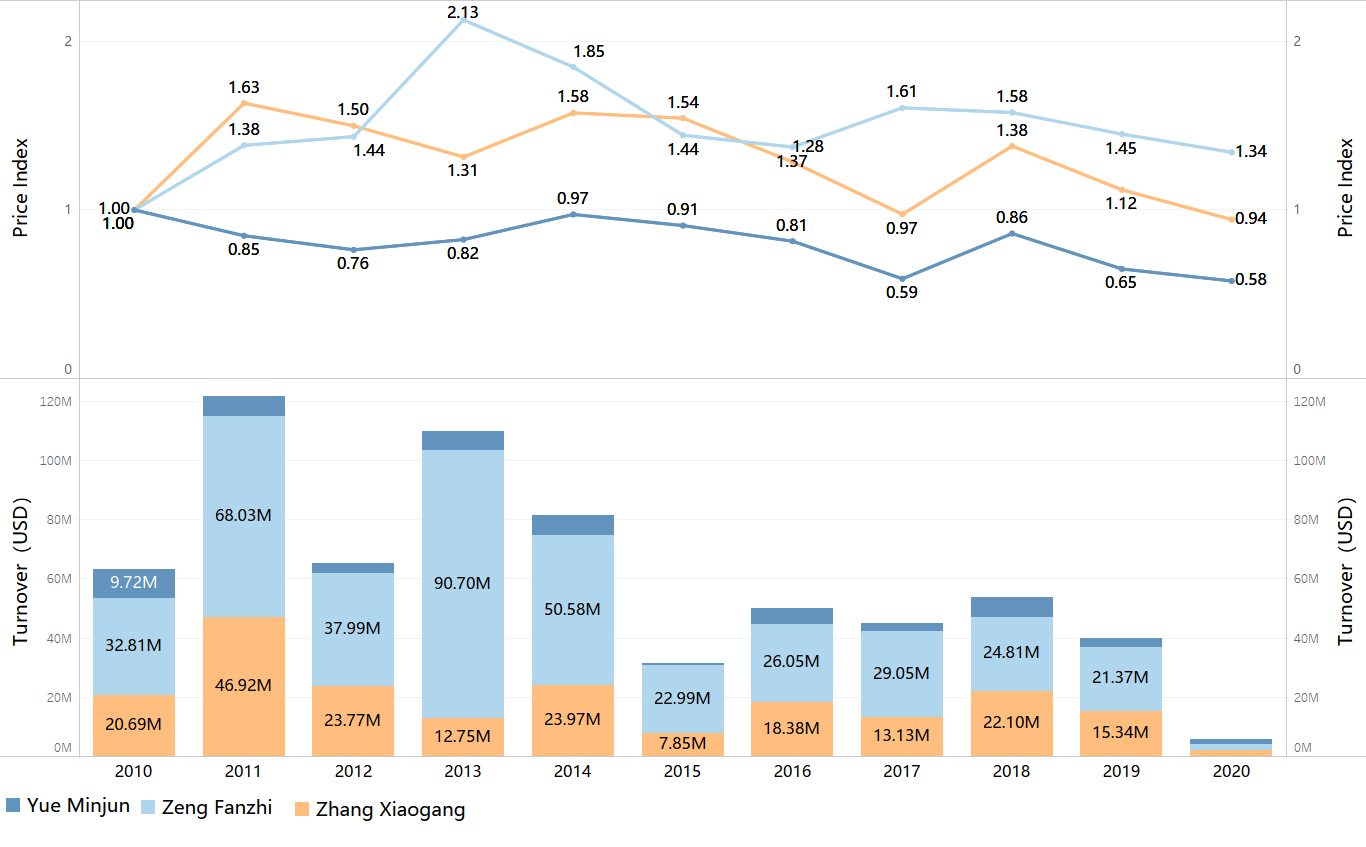

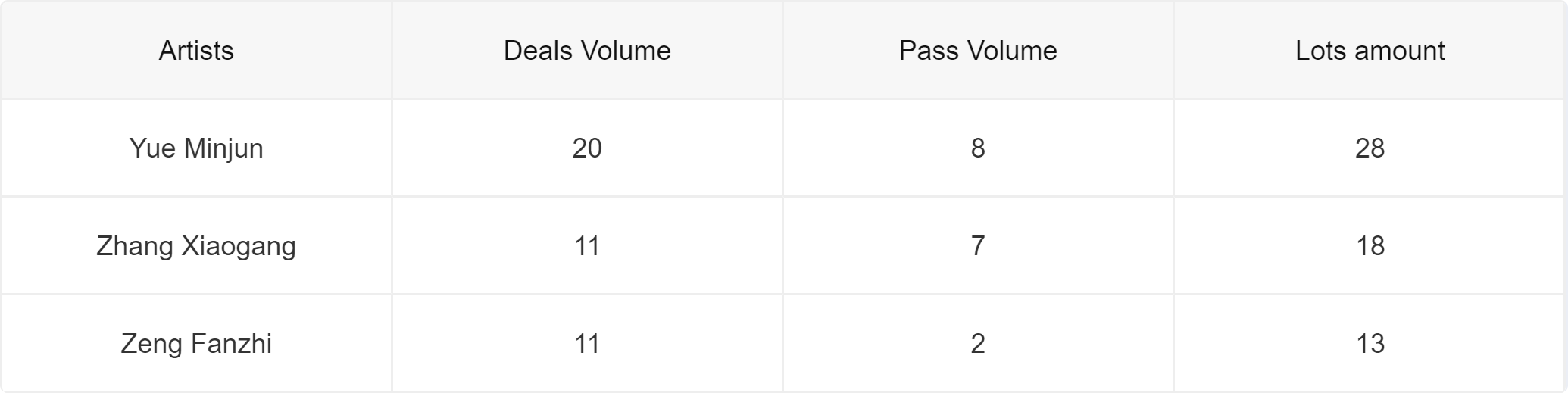

Chinese Contemporary Artists: No Noticeable Improvement in Sales

The price index of the three Chinese contemporary artists represented by Zhang Xiaogang has been at a low level in recent years. In 2020, their total turnover is not outstanding under the fluctuation of the art market. So far, Zeng Fanzhi has a sold-by-lot rate of 84%, with 3 works over US $1m. The sold-by-lot rate of Zhang Xiaogang is 68%, with only one work worth US $1m and 4 works over US $100,000. Yue Minjun has only 3 works over US $100,000.

Conclusion: The post-pandemic market is more rational. Some artists are able to withstand the market gloom and remain the mainstay at sales, while other artists lose some of their heat. It is finding the best point to increase property in ups and downs that makes the market so interesting. The high prices of the highlights are surprising but in expectation, indicating that fine classic works are with priceless value under any conditions, and their high prices are deserved. What will happen to the art market in the second half of 2020? Let’s wait and see. ArtPro will keep focus on the market for more information.